We use cookies to make its website more user-friendly, secure and effective. Cookies collect information about the use of websites. Further information: Information on data protection

An introduction to first and second mortgages.

First and second mortgages in simple terms.

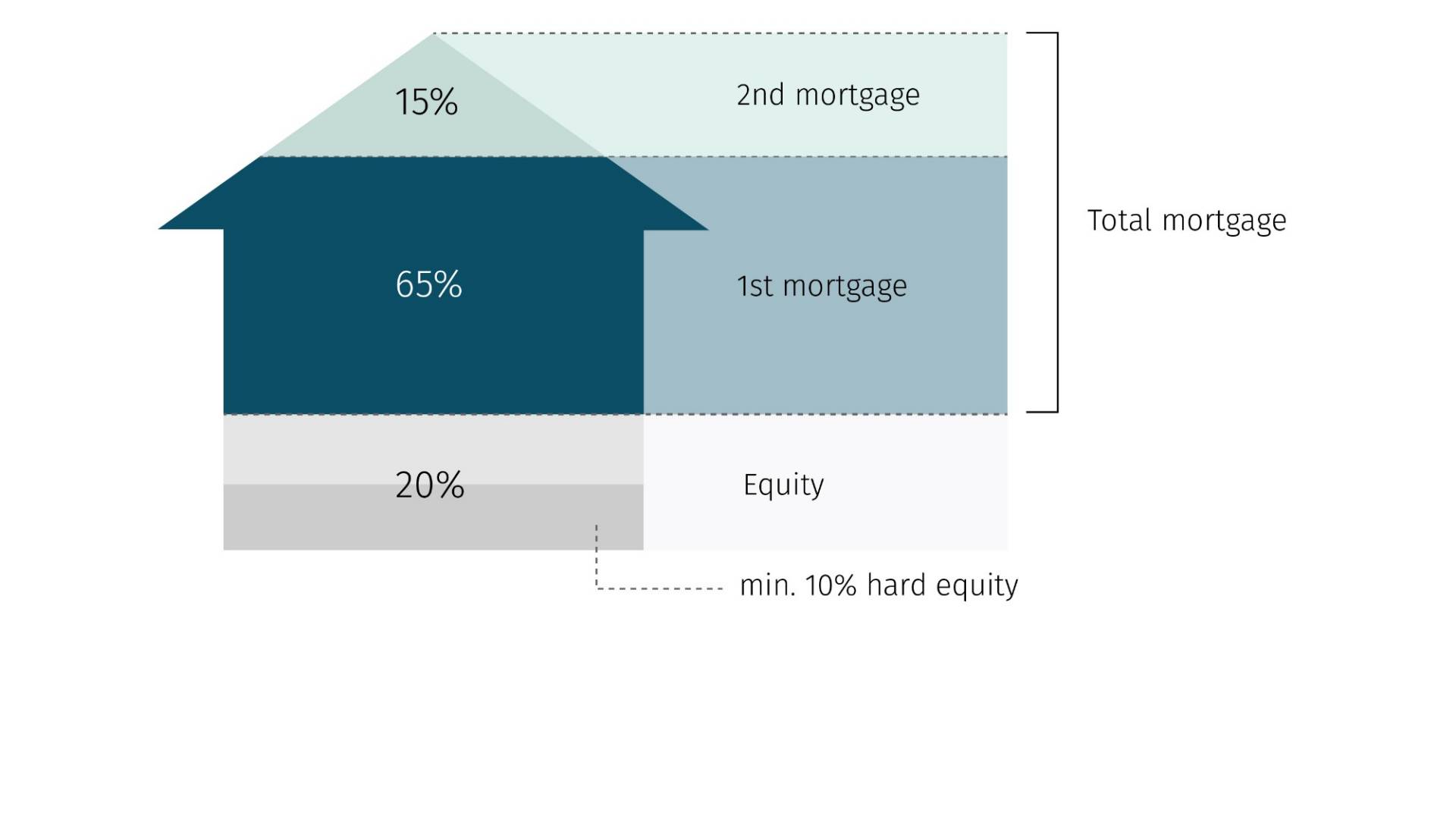

Financial institutions usually provide 80% – and in exceptional cases up to 90% – of the purchase or construction price as a mortgage for residential property. The remaining 20% must be provided in the form of a deposit. In the case of borrowed capital, there is a distinction between the first and the second mortgage, whereby the first mortgage can amount to up to 65% of the property value and the second covers the rest up to a maximum of 80% (or 90%). The reason for subdividing the loan is that, with a second mortgage, there is an obligation to repay it. It must be repaid within 15 years or, in the case of most lenders, by the time the borrower reaches pension age at the latest. This amortisation ensures that borrowers have less debt and a greater capital buffer for any value corrections as they age. In Switzerland, the first and second mortgage are mostly take out with the same lender, as there are no institutions that only finance second mortgages.

What is the difference between the first and second mortgage?

So-called first mortgages have a loan-to-value ratio of up to 65%

Main loan up to 65% of the property value

No amortisation obligation, provided affordability is ensured

Direct and indirect amortisation possible

Different mortgage models (fixed-rate mortgage, Saron mortgage or variable-rate mortgage) or a combination possible

Often more attractive interest terms if only a first mortgage is needed

Financial institutions grant a second mortgage with a loan-to-value ratio of between 65 and 80% (or up to 90% in exceptional cases)

Additional loan between 65 and 80% (or 90%) of the property value

Obligation to amortise within 15 years or, in most cases, by retirement at the latest

Direct and indirect amortisation possible

Different mortgage models (fixed-rate mortgage, Saron mortgage or variable-rate mortgage) or a combination possible

Higher tax deductions due to higher interest payments

Amortising the first and second mortgage.

Since 2014, the second mortgage has been subject to an amortisation obligation and must be repaid within 15 years or, in the case of most lenders, by the time the borrower reaches pension age. This is generally done through direct or indirect amortisation.

The amortisation obligation only affects the second mortgage. The decision as to whether and how the first mortgage is amortised depends on individual factors such as life circumstances, affordability, tax-related issues and alternative investment options. Seeking professional advice can help you choose the best strategy.