We use cookies to make its website more user-friendly, secure and effective. Cookies collect information about the use of websites. Further information: Information on data protection

Amortising your mortgage. Direct or indirect?

Amortisation in simple terms.

Amortisation refers to the full or incremental repayment of a mortgage over a certain period of time. The borrowed amount is usually repaid in regular instalments until all of the debt has been settled. There are two options when it comes to amortisation: direct and indirect amortisation.

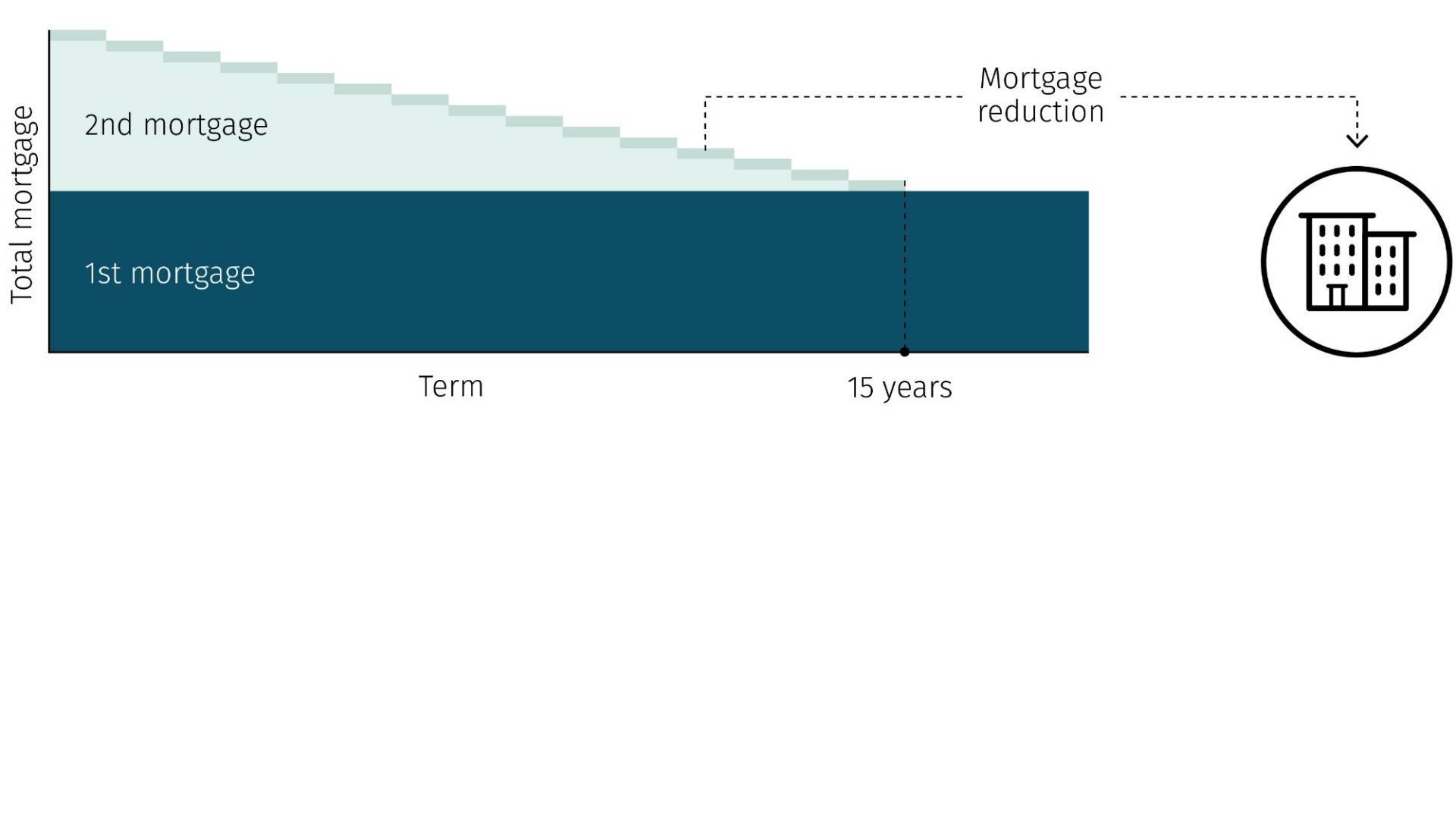

What does direct amortisation mean?

With direct amortisation, the value of the mortgage is reduced through a one-off repayment or regular repayments. The interest costs for the remaining mortgage amount decrease with every repayment.

Advantages of direct amortisation.

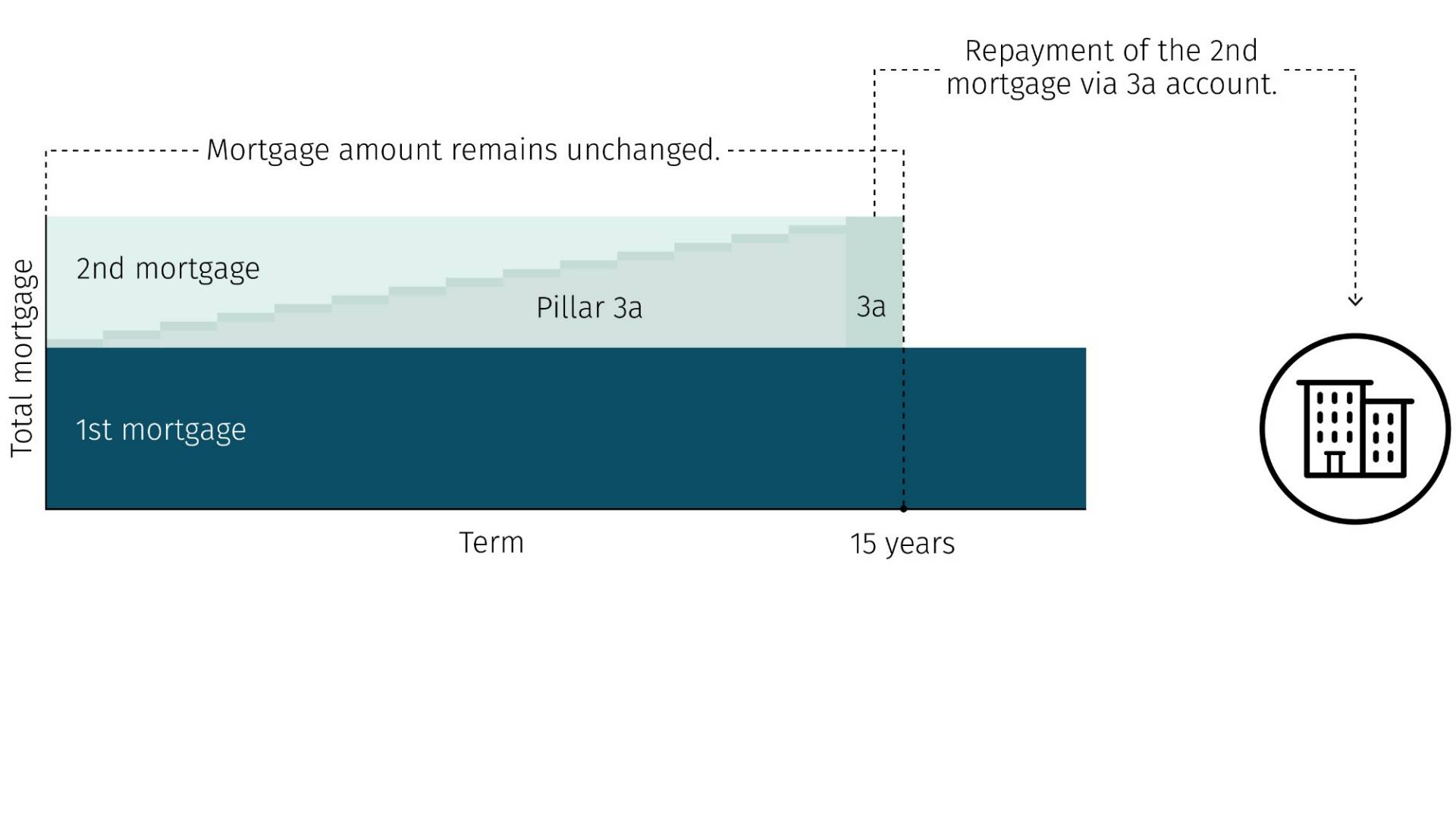

What does indirect amortisation mean?

With indirect amortisation, repayments are made in the form of deposits into a separate savings, pension or investment product instead of reducing the value of the mortgage directly. The value of the mortgage remains the same over the entire term and is only reduced at the end of the term or at a time defined when the mortgage is taken out.